Will the Spokane Housing Market Crash in 2025? Expert Predictions

- Nick Briggs

- Aug 25, 2025

- 4 min read

Updated: Sep 29, 2025

Will the Spokane Housing Market Crash in 2025?

Every homeowner (or prospective seller) in Spokane is asking: Will the Spokane housing market crash in 2025? With rising mortgage rates, growing inventory, and changing buyer demand, it’s natural to wonder whether the market could stumble or even collapse. In this blog, I’ll walk you through the data, expert predictions, risk factors, and a step‑by‑step plan to help you make informed decisions. (I’m a Spokane real estate agent — and that’s precisely why I’m writing this blog.)

What Does a “Housing Market Crash” Really Mean?

A housing market crash typically involves a rapid and steep decline in home prices — usually more than 10% — triggered by economic turmoil, overbuilding, or buyer pullback. For Spokane, a crash would require sustained inventory spikes, sharp drops in sales, and price depreciation across most segments.

Spokane Housing Market Snapshot (as of 2025)

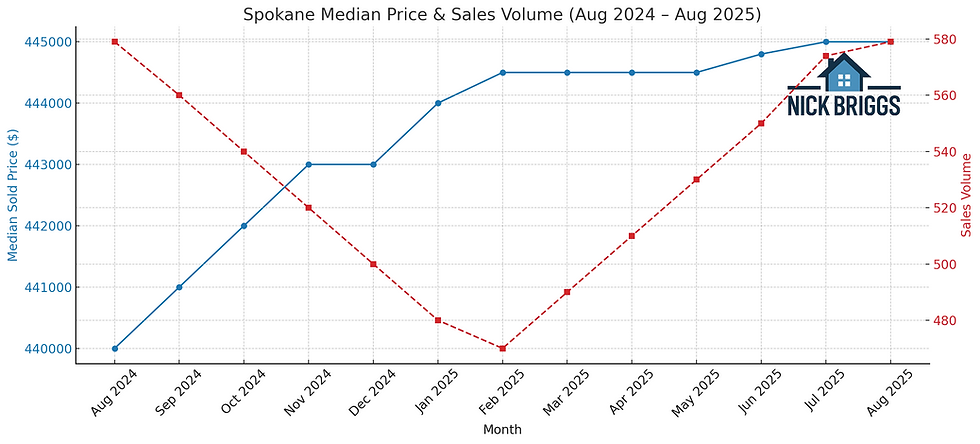

Price & Sales Trends (Year-Over-Year)

Median Sold Price: $445,000 — unchanged from July 2025; up 1.1% from August 2024

Average Sold Price: $515,000 — up 1% month-over-month and 4.7% year-over-year

Average Price/Sq Ft: $218 — down 2.2% from July and down 0.9% year-over-year

Sold Listings: 579 — same as August 2024; up 0.9% from July

Inventory and Buyer Activity

Active Listings: Up 33% YoY, and up 2.6% MoM

Months of Inventory (Closed Sales): 3.4 — up 31.4% YoY

Properties Under Contract: 618 — up 7.1% YoY and 5.6% MoM

Absorption Rate (Closed Sales): 29.5% — down 24.7% YoY

Days on Market (DOM): 32 days — up 18.5% YoY and 23.1% from July

This data suggests a neutral market, but early signs of softening are visible — notably in DOM and absorption rate.

Expert Forecasts for Spokane in 2025

Modest Growth or Mild Correction?

Despite growing inventory, home values have held steady or increased slightly.

Forecasts from Zillow and local experts expect flat to +1% appreciation by year-end, assuming stable mortgage rates and economic conditions.

A crash scenario would require additional stressors not currently visible in the data.

Risk Factors That Could Lead to a Spokane Housing Market Crash

Mortgage Rates Above 7%: A sharp rate hike would reduce affordability and shrink the buyer pool.

Excess Supply Without Demand: A surge in new construction or resale listings without matching demand could suppress prices.

Spokane Job Market Deterioration: Unemployment spikes or major employer exits could reduce housing demand.

Macro-Level Recession or Banking Instability: A national downturn would affect local consumer confidence and investment activity.

Buyer Hesitancy and Reduced Confidence: If market psychology shifts and buyers expect prices to fall, demand could dry up.

Why a Spokane Housing Market Crash in 2025 Is Unlikely

The market is still neutral, not buyer-dominated.

Home prices are stable, with modest increases year-over-year.

Absorption rate and DOM are shifting, but not dramatically enough to signal a crash.

Inventory is rising but remains within a manageable 3.4 months — still below buyer’s market levels.

Step‑by‑Step Guide for Spokane Homeowners & Sellers in 2025

Step 1: Monitor Local Stats Monthly

Keep tabs on inventory, DOM, absorption rate, and median prices.

Step 2: Time Your Sale Intelligently

If inventory continues rising and demand cools, listing sooner may preserve more equity.

Step 3: Optimize Your Home for a Quick Sale

Focus on updates that improve curb appeal and functionality. Pro Tip: Don’t over-upgrade — aim for high ROI improvements.

Step 4: Price Right From Day One

With a slowing market, accurate pricing is critical. I can help you run competitive comps.

Step 5: Work With a Trusted Spokane Real Estate Agent (Me!)

You need a partner who watches the data daily and tailors your strategy — that’s exactly what I do.

When to Call It a Correction vs. a Crash

Metric | Correction | Crash |

Price Drop | 3–7% | 10%+ |

Inventory Growth | 20–40% | 75–100% |

DOM Increase | 5–10 days | 20+ days |

Absorption Rate | 25–30% | Below 20% |

Spokane's DOM (32 days) and Absorption Rate (29.5%) place it squarely in “cooling” territory — not crash levels, but worth watching.

Conclusion: Be Alert, Not Alarmed

While the Spokane housing market crash is a common fear, current indicators suggest neutral conditions with softening trends, not a collapse. That said, it’s wise to track conditions closely, price competitively, and stay ahead of local shifts.

As your Spokane real estate agent, I’m here to help you strategize, sell smart, and protect your equity — whatever the market brings.

Frequently Asked Questions (FAQ)

Will the Spokane housing market crash in 2025? Not likely. Inventory is growing, but prices are holding steady, and demand is still present.

Could there be a Spokane housing market crash? It’s possible under extreme economic or interest rate pressure, but current data does not indicate a crash trajectory.

What will Spokane housing prices do in 2025? Experts expect flat to slight growth — around 0.5% to 1.1% depending on how the market responds to interest rates and inventory.

How much could Spokane home values decline? In a moderate correction, prices could dip 3–5%. A crash scenario would involve 10%+ declines, which is currently unlikely based on the numbers.

About Me

My name is Nick Briggs

Being born and raised in Spokane, I grew up knowing what a special place this city is. It was my dream to help others create a life in this wonderful community by guiding them in real estate. I spent many years in the customer service industry. The experience of listening and communication showed me how much I truly loved helping people. I attended Gonzaga University and earned a Bachelor’s Degree in Business Administration to add to my knowledge of guiding, managing, negotiating, and listening to individuals, helping them achieve their real estate goals.

Comments